ForLife Education Plan is exactly what you need to help you save for your child’s high school or university costs.

- Provides a high guaranteed return of 110% of sum assured.

- Benefit will be paid for your child to complete high school or university, at the time the fees become due.

- Option to keep the guaranteed benefit with Fortune Life longer to accumulate additional interest.

- Premium payments are waived if the policy owner becomes critically ill, disabled, or passes away.

Guaranteed 100% of Sum Assured paid on Death or Total and Permanent Disability (TPD) of the Life Assured

Guaranteed 110% of Sum Assured paid on maturity

Additional coverage available to protect against unfortunate events to the person paying the premium

Low cost, affordable premium

How the plan works

Mrs Nita, 35 years old, buys a ForLife Education Plan (University Option) for her 3 year old daughter, with a benefit (the Sum Assured) of US$ 10,000. She is worried about her daughter not being able to go to university if anything unforeseen happens to her and she cannot maintain the savings plan. Mrs Nita therefore attaches Fortune Life’s Accident Protect and Critical Illness Protect+ plans to take away her worry and guarantee the university fees can be paid.

At maturity (the time when the savings plan ends), Mrs Nita will receive a guaranteed 110% of the benefit (the Sum Assured). This is paid out as follows to cover the cost of her daughter’s university fees:

Mrs Nita

| Insurance Plan | Life Assured’s Age (Last Birthday) | Guaranteed Benefit | Total Benefit |

|---|---|---|---|

| ForLife Education Plan (University Option) | 19 | US$ 2,000 | US$ 11,000 (110% return of total Sum Assured US$ 10,000) |

| 20 | US$ 2,500 | ||

| 21 | US$ 3,000 | ||

| 22 | US$ 3,500 |

Should an unfortunate event happen to either Mrs Nita’s daughter (the Life Assured) or Mrs Nita (the Policy Owner) herself, the following benefits will be paid:

| Coverage | Benefit | ||

|---|---|---|---|

| Policy Owner (Mrs Nita) | Accidental Death or Total Permanent Disability | US$ 10,000 | |

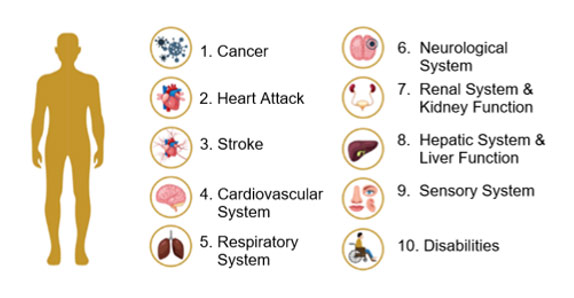

| Impairment or surgery on organ functions which includes:

| Early Stage | US$ 5,000 | |

| Late Stage | US$ 10,000 Less payment made in Early Stage (if any) | ||

| Life Assured (Mrs Nita’s daughter) | Death or Total Permanent Disability | US$ 10,000 | |

We can also provide you and your family with additional protection through your ForLife Education Plan. Find out more below.

Critical Illness Protect+

Suffering serious long-term health conditions would be a very difficult experience for both you and your family. It would be made even more difficult if you are your family’s income earner.

Fortune Life’s “Critical Illness Protect+” provides cash lump sum either when you are diagnosed with impairment or surgery on your key System and Organ Functions, both during early and late stages. This cash sum can help replace your income, leaving you and your family to focus on your recovery.

Accident Protect

We all face the risk of an unexpected accident 24 hours a day, 7 days a week. How would your family cope if you have a serious accident?

Accident Protect from Fortune Life can help by providing a cash lump sum that you can use however you wish. If you are the family’s main income earner, the cash sum can be used to replace lost income whilst you recover and are able to return to work again.