A policy that protects your loved ones from financial burden by

paying off your loan should an unfortunate event befall you

Hightlights:

- Your family does not need to worry about paying off debts when you are not around.

- Low-cost protection, to ensure your loved ones can live debt-free.

- Matches your loan amount.

Insurance Benefits

100% Sum Assured or Reducing Sum Assured paid on death or total and permanent disability

Level Sum Assured of $5,000 in the event of accidental death or total and permanent disability

Level Sum Assured or

Reducing Sum Assured Options

Single Premium or

Regular Premium Options

How the plan works

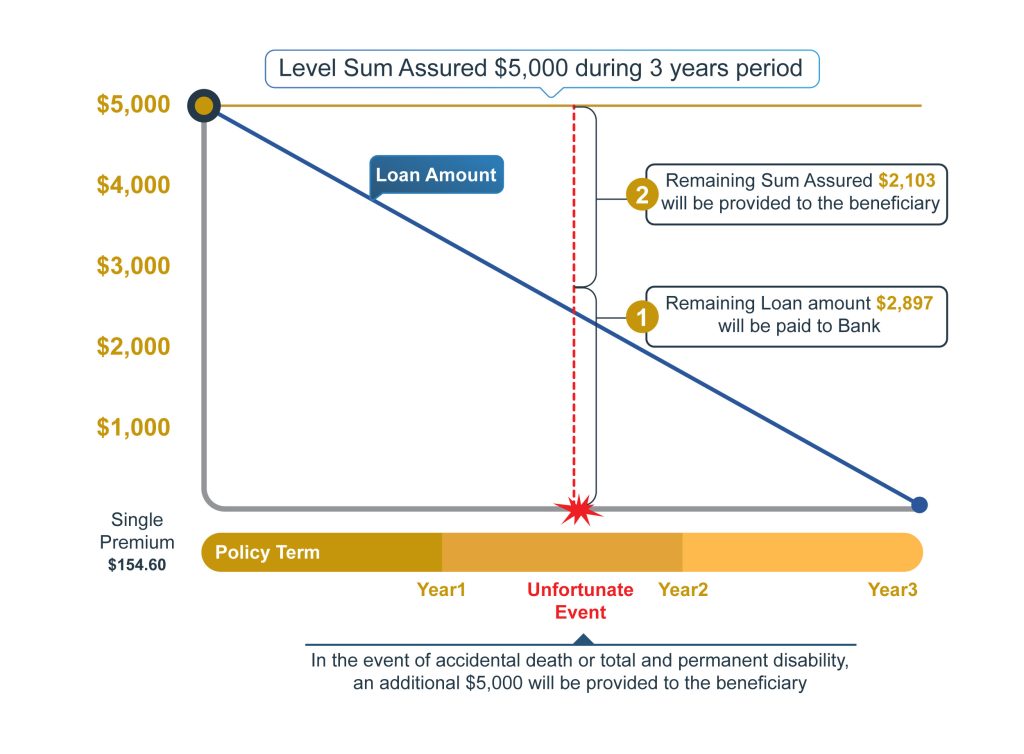

Mr. Sambath, age 30 years, takes a loan of $5,000 with a repayment term of 3 years from the financial institution. At the same time, he purchased “ForLife Loan Protection Plan”, with level sum assured to ensure that the loan would not become a financial burden to his family if he is not around, Mr. Sambath paid single premium $154.60 to purchase this plan.

In the event of any unfortunate incident occurring to Mr. Sambath in the 18 months (1.5 years) after purchasing the Plan, the Company will settle the outstanding loan balance of $2,897 and the remaining $2,103 will be payable to Mr. Sambath’s family (the beneficiary).

Mr Sambath